Budgeting is the backbone of successful event planning. Whether you’re organizing a corporate conference, a trade show, or a wedding, costs can quickly spiral out of control if you don’t have a structured approach to managing expenses.

Most event planners start with good intentions, but without a proper system, it’s easy to lose track of spending. Unexpected costs pop up, vendor fees fluctuate, and last-minute changes throw off even the best-laid plans. That’s where an event budget template comes in—it keeps everything organized, ensures you stay within budget, and helps you make smarter financial decisions.

A well-structured budget template gives you a clear picture of every expense. It breaks down costs into categories, tracks revenue streams, and allows you to adjust spending as needed. Instead of relying on guesswork, you’ll have real numbers guiding your decisions.

This guide walks you through how to create an event budget template that works for any type of event. You’ll learn what to include, how to estimate costs, and which tools can make the process easier. By the end, you’ll have everything you need to keep your event finances on track without unnecessary stress.

Step-by-step guide to creating an event budget template

A solid event budget template isn’t just a spreadsheet filled with numbers. It’s a financial blueprint that helps you track every dollar and ensures your event stays on course. Without one, it’s easy to underestimate costs, overspend, or leave out crucial expenses.

Here’s a step-by-step breakdown of how to create an event budget template that works for you.

Step 1: Define event objectives & budget limits

Before listing out expenses, start with the big picture. What’s the purpose of the event? Who is the target audience? What kind of experience do you want to create? Answering these questions helps determine where the money should go.

Once you have clarity on the event’s goals, establish a budget ceiling—the maximum amount you’re willing to spend. If revenue is involved (ticket sales, sponsorships, exhibitor fees), set financial targets to ensure you’re covering costs and generating a profit.

Key questions to ask:

- What’s the total budget for the event?

- What are the expected revenue sources?

- Are there any cost restrictions or non-negotiable expenses?

Step 2: List & categorize expenses

A well-organized event budget template separates fixed and variable costs.

Fixed costs are essential expenses that don’t change much, such as venue rental, permits, and insurance.

Variable costs fluctuate based on attendance or external factors, like catering, marketing, and speaker fees.

Common budget categories to include:

- Venue & logistics: Rental fees, security, transportation, permits

- Catering & beverages: Per-person costs, service fees, gratuities

- Marketing & promotions: Advertising, social media, printed materials

- Entertainment & speakers: Fees, travel, accommodations

- Technology & equipment: AV setup, WiFi, event apps

- Miscellaneous & contingency: Unexpected costs, last-minute adjustments

Once everything is listed, assign estimated costs to each category. A detailed template prevents overspending and ensures no major expenses get overlooked.

Step 3: Research & estimate costs

Cost estimation isn’t just about guessing. It requires research. Reach out to vendors, compare pricing, and review past event budgets for reference.

Pro tips for accurate estimates:

- Get at least three quotes for major expenses

- Account for taxes, service fees, and gratuities

- Add a buffer (10-20%) for unexpected costs

Tracking actual expenses against estimates helps fine-tune the budget in real-time. If one category exceeds its limit, adjustments can be made elsewhere.

Step 4: Allocate funds wisely

Not every dollar in the budget carries the same weight. Prioritize spending on things that directly impact the event’s success.

Where to focus budget allocation:

- High-quality venues and catering if guest experience is key

- Marketing and promotions if ticket sales are the priority

- AV setup and speakers if content delivery is crucial

A well-balanced budget ensures every aspect of the event is properly funded without cutting corners where it matters most.

Step 5: Track & adjust the budget in real time

Budgeting isn’t a one-time task. Keeping an eye on actual expenses ensures you don’t overspend before the event even starts.

How to stay on track:

- Use budgeting software to automate tracking

- Review financials weekly to identify cost overruns early

- Reallocate funds if one category exceeds its limit

The best event planners adjust their budgets as they go. Flexibility allows for smart decision-making without compromising the event’s success.

A structured event budget template keeps planning stress-free. It eliminates uncertainty, ensures every dollar is accounted for, and helps maximize the event’s impact. Next, we’ll look at the best tools available to make budgeting even easier.

Best tools & software for event budgeting (momencio ROI calculators)

Even the best event budget template needs the right tools to track expenses, measure ROI, and adjust spending in real time. Spreadsheets work for basic planning, but they don’t provide the insights needed to optimize costs and maximize returns. That’s where momencio’s ROI calculators come in.

These tools help event planners make data-driven financial decisions. Instead of relying on rough estimates, you can analyze real-time numbers to see what’s working and where adjustments are needed.

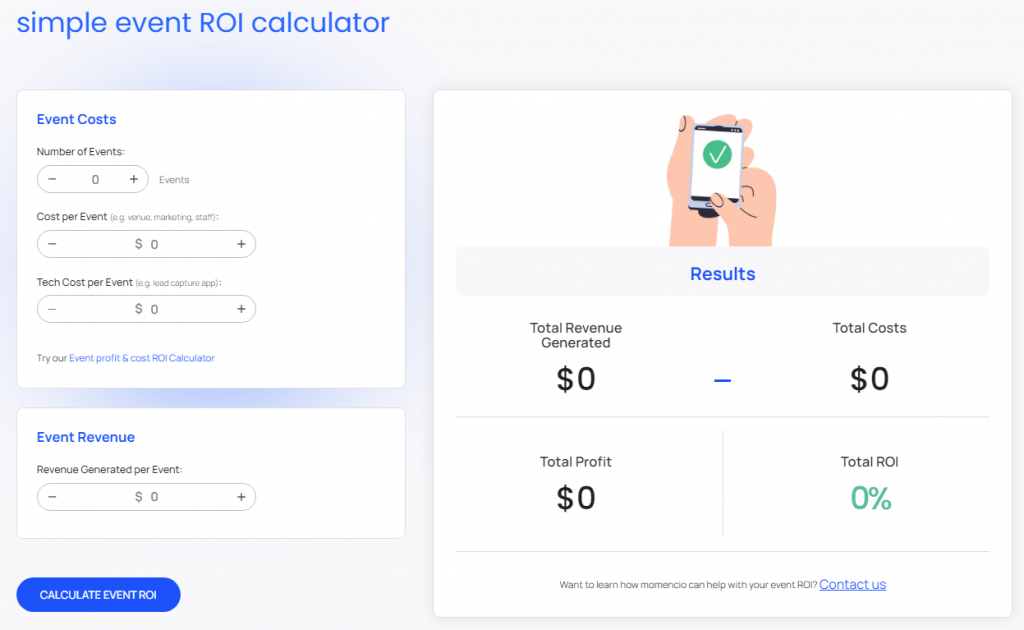

Simple event ROI calculator

Tracking event ROI doesn’t have to be complicated. The Simple Event ROI Calculator breaks it down into an easy-to-understand format.

- Calculates the return on investment by comparing total revenue and expenses

- Helps planners evaluate financial performance without complex formulas

- Provides a quick snapshot of how profitable the event is

This tool is perfect for event organizers who want a fast and clear overview of their event’s financial success.

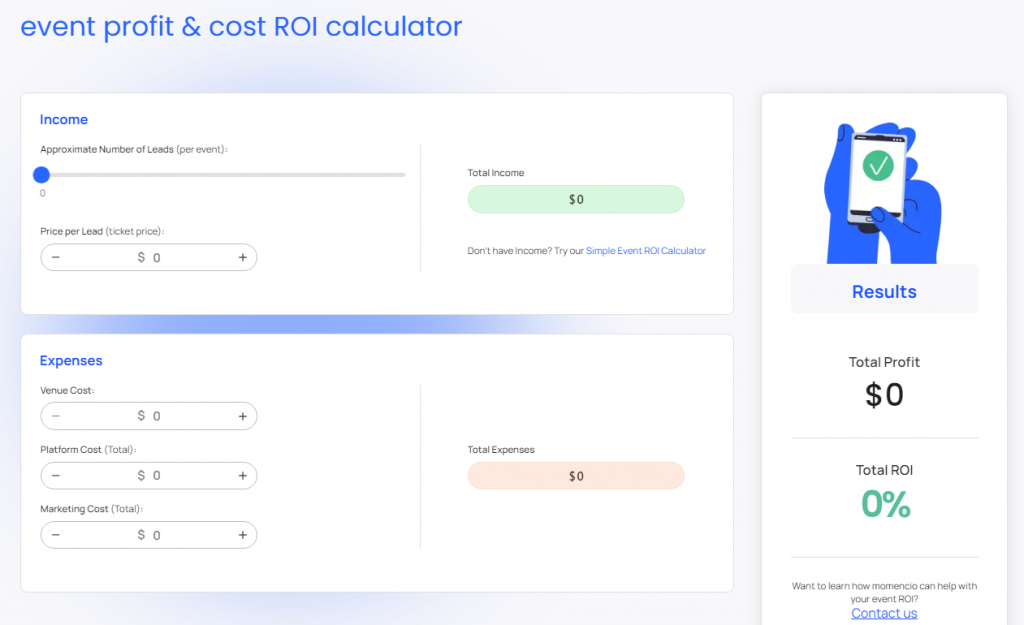

Event Profit & Cost ROI Calculator

Understanding profitability requires a deeper look into revenue and expenses. The Event Profit & Cost ROI Calculator offers a detailed financial analysis to ensure every dollar is accounted for.

- Tracks total event income and breaks down cost categories

- Analyzes profit margins to determine if the event is financially viable

- Helps event planners optimize spending for better returns

For events with multiple revenue streams—ticket sales, sponsorships, exhibitor fees—this calculator ensures every financial aspect is properly measured.

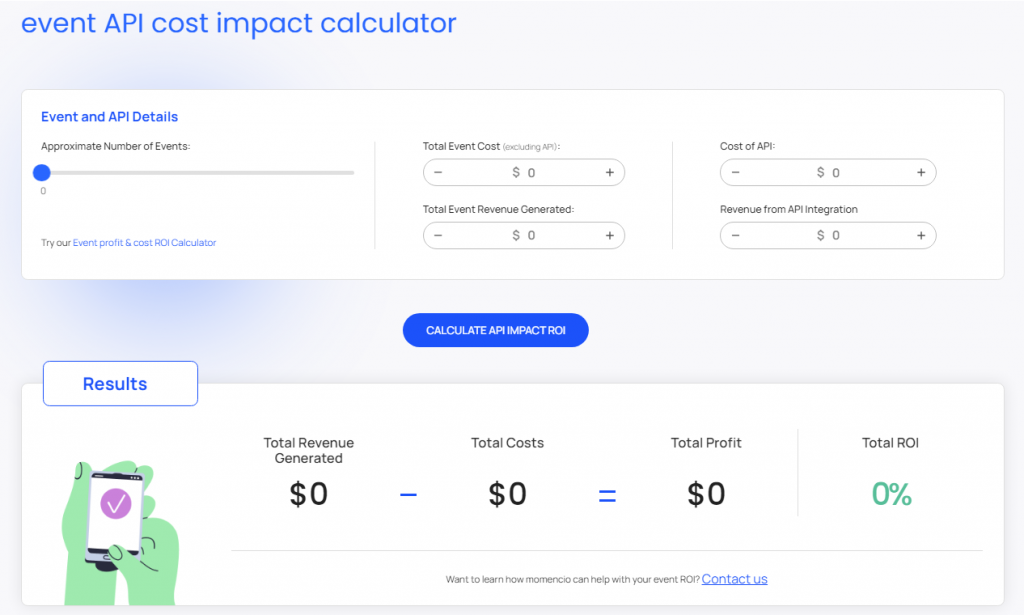

Event API cost impact calculator

Technology plays a huge role in modern events, but is the investment worth it? The Event API Cost Impact Calculator helps determine whether API integrations are delivering value.

- Evaluates the financial impact of integrating APIs into event systems

- Helps planners understand whether tech investments are cost-effective

- Assists in making data-driven decisions about software, automation, and digital tools

From event apps to CRM integrations, technology can be a game-changer—if it justifies the cost. This tool ensures planners invest where it truly matters.

Using the right budget tracking tools isn’t just about staying within limits—it’s about maximizing impact. momencio’s ROI calculators provide the insights needed to make informed financial decisions and improve future event planning strategies.

Pro tips for keeping your event budget on track

A well-planned event budget template helps control costs, but even the best financial plan can go off course. Unexpected expenses, last-minute changes, and vendor price fluctuations can throw everything into chaos. Staying on track requires a proactive approach. Here’s how to keep your budget in check without compromising the quality of your event.

Negotiate with vendors

Vendors expect some level of negotiation, so don’t settle for the first price they offer. Compare quotes, ask about bundled discounts, and see if there’s room for flexibility.

- Book early to lock in lower rates before prices increase.

- Bundle services like venue, catering, and AV to get package deals.

- Ask for value-adds instead of discounts (extra decor, extended rental time).

Negotiating smartly can save thousands without affecting the quality of the event.

Use budgeting apps for real-time tracking

Manually updating spreadsheets can lead to missed costs and overlooked expenses. Digital budgeting tools provide real-time tracking and automated cost updates.

- Sync momencio’s ROI calculators with event financials for an up-to-date overview.

- Use cloud-based spreadsheets so multiple team members can update expenses instantly.

- Set up alerts for spending limits to avoid exceeding budget caps.

Keeping all expenses in one centralized system makes financial tracking effortless.

Monitor spending weekly

Waiting until the event is over to review finances is a costly mistake. Regular check-ins help catch issues early and allow adjustments before it’s too late.

- Schedule weekly budget reviews to compare estimated vs. actual costs.

- Identify overages early and adjust spending in less critical areas.

- Keep a contingency fund (10-20% of the total budget) for surprises.

Consistent tracking ensures the budget stays aligned with financial goals.

Plan for contingencies

No matter how well an event budget template is structured, unexpected expenses will arise. A contingency fund provides a safety net.

- Allocate at least 10-20% of the budget for unplanned costs.

- Categorize potential risks like last-minute venue changes or speaker cancellations.

- Track which contingency funds get used to improve budgeting for future events.

Having a financial buffer prevents stressful last-minute cutbacks.

Evaluate post-event financials

The budget process doesn’t end when the event is over. A post-event financial review identifies what worked, what didn’t, and where to improve.

- Compare budgeted vs. actual expenses to see where costs ran high.

- Measure ROI using Momencio’s calculators to determine event profitability.

- Document lessons learned to refine budgeting for future events.

Every event is a learning experience, and a solid financial review ensures the next one is even more efficient.

Budgeting isn’t just about spending less—it’s about spending smart. When costs are tracked proactively, financial surprises are minimized, and resources are allocated where they create the biggest impact.

FAQs

- What is the best format for an event budget template?

- An event budget template should be structured in a way that makes tracking expenses simple and transparent. Most planners use spreadsheets (Excel or Google Sheets) with categorized expense columns, estimated vs. actual costs, and a contingency fund. For a more advanced approach, budgeting software and Momencio’s ROI calculators provide real-time tracking and deeper financial insights.

- How do I estimate event costs accurately?

- Accurate cost estimation comes down to research and vendor comparisons. Get at least three quotes for major expenses, factor in service fees and taxes, and review past event budgets for reference. Always add a 10-20% buffer for unexpected costs to avoid overspending.

- What percentage of an event budget should be allocated to marketing?

- Marketing costs vary depending on the type of event, but 10-20% of the total budget is a common range. If ticket sales or sponsorships drive revenue, investing more in promotion may be necessary. Tracking marketing ROI with Momencio’s tools helps ensure ad spend is generating results.

- How do I cut costs without affecting event quality?

- The key to reducing costs while maintaining event quality is prioritization and smart negotiations. Focus spending on high-impact areas like venue, catering, and entertainment while cutting back on non-essential extras. Work with vendors to get bundled deals, seek sponsorships, and use cost-effective digital marketing instead of expensive traditional ads.

- Can I use AI or automation for event budgeting?

- Yes, AI-driven budgeting tools help track expenses, analyze spending patterns, and predict cost overruns before they happen. Momencio’s ROI calculators offer real-time financial insights to optimize event budgets and improve planning efficiency. Automating financial tracking minimizes errors and saves planners valuable time.